Best rental yields in France

Investing in property? Find out the highest thus best rental yields in France.

504 billion euros is the amount of rental expenditure in France. This represents 21.9% of the national GDP. This means that investing in France is a godsend in more ways than one:

- Real estate has jumped by 22% in ten years;

- France welcomes 90 million tourists a year;

- The rule of law guarantees ownership;

So, if you are considering buying a holiday home in France, or any other type of property investment, there is no such thing as the best French city for rental investment. It is necessary to say that there are many “the” best cities because it is one of the most touristy countries in the world.

Table of contents

- What are the best cities to invest in real estate in France?

- Is buying real estate in France a good investment?

- What is the average rental yield in France?

- Why invest in property in France?

- Can foreigners buy real estate in France?

- Is this the right time to buy real estate in France?

- Short, mid or long-term?

- Invest in France with GuestReady

What are the best cities to invest in real estate in France?

Finding the most profitable cities to invest in property requires knowing what type of rental you want to do. If you’re looking to maximise your profits, there’s no doubt that short-term rentals are what you should be looking at.

In this case, the major tourist cities in France should be your number one choice. Why? Because the main risk in short-term rentals is a vacancy. However, in the major French cities, there is hardly any vacancy.

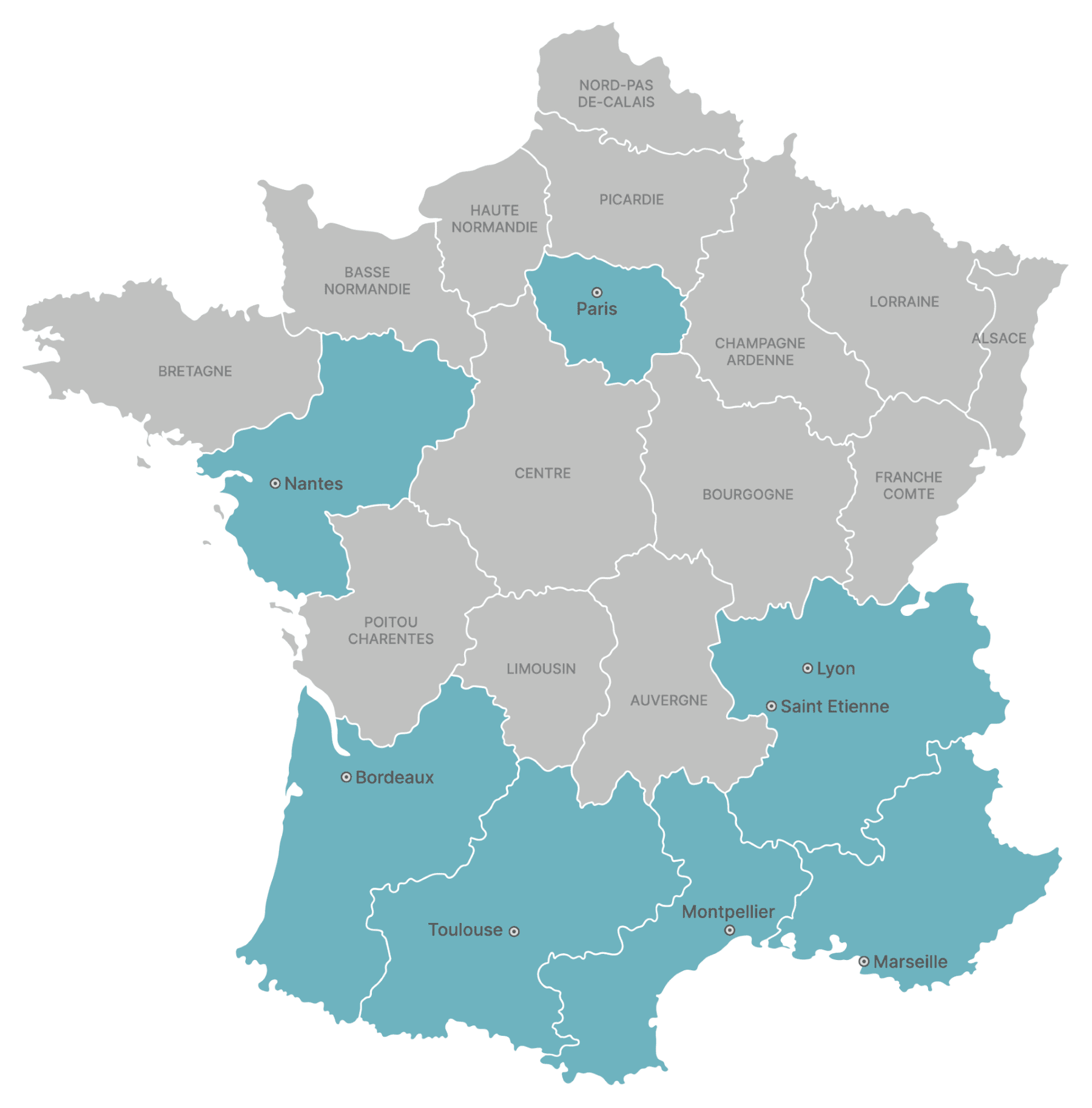

So let’s take a look at eight of the largest cities in France that are the best areas to invest in property in France.

Buy to let Saint-Etienne

- 7.5% rental yield

- 1.286€ average price/m2

Saint-Etienne is a medium-sized city, with only 170,000 inhabitants, compared to over 220,000 fifty years ago. So why invest in Saint-Etienne? Because the rental profitability is between 7% and 8% gross, precisely because of a particularly affordable price per square metre. Saint-Etienne thus has one of the best rental yields in France.

The average price per square metre is €1.286, with a minimum of €842 per square metre in the Montreynaud district, and €1.502 per square metre in the Monthieu-Saint-François district. Added to this is a demographic upward trend since 2015, combined with a 22% increase in property value over the last 5 years.

All the indicators are therefore in the green, both in terms of rental yield and capital gain on the sale. Adding the 1.1 million overnight stays in the Loire department, Saint-Etienne is an ideal city to invest in short-term rentals.

Buy to let Toulouse

- 6% rental yield

- 3.551€ average price/m2

The pink city offers an average annual rental yield of between 5% and 6% gross. Investing in Toulouse is, therefore, in terms of rental profitability, comparable to the cities of Lyon and Marseille. However, where Toulouse comes out on top is in terms of the price per m².

Indeed, the average value per m² is €3.551, with a minimum of 2.308€/m² in the Mirail district, and a maximum of 4.940€/m² only in the Capitole. Above all, short-term rentals do not start below €70 per night for a studio in the city centre, rising to over €700 depending on the property.

With 5.5 million visitors a year coming to enjoy its extraordinary city centre and the banks of the Garonne, short-term rental vacancies are almost non-existent in the heart of the Pink City.

Buy to let Montpellier

- 6% rental yield

- 4.000€ average price/m2

Montpellier, with its Mediterranean climate, beaches accessible by bike or public transport, and the foothills of the Massif Central to the north, is a popular destination for tourists. This is why Montpellier has more than 1.5 million overnight stays per year. A figure that is constantly increasing.

So, buying property in Montpellier, France, is the assurance of owning real estate in a region where it would be nice to spend your retirement. Meanwhile, the city promises a gross rental yield of almost 6%. With companies like GuestReady, short-term rentals are not only possible anywhere, but also allow you to occupy the property for a few weeks of the year for your own holiday.

The average price per square metre in Montpellier is just over 4.000€/m², while property prices have risen by 35% in 5 years. For example, a flat in La Mosson will cost only €2,366 per square metre, while in Les Beaux-Arts it will cost only €5,081 per square metre. Montpellier is developing, and prices are rising. As in other cities in France, it is time to make investments.

Buy to let Lyon

- 5.5% rental yield

- €5.274 average price/m2

Lyon, the city of lights, has also seen a very strong increase in the price per square metre in ten years, with a variation of 67.03%. This metropolis of half a million inhabitants is perfect for rental investments, with a gross yield of around 5.5%.

Buying a house in Lyon will cost you an average of €5,274 per square metre, with a minimum of €4,312 per square metre in the 9th arrondissement, and a maximum of €6,256 per square metre in the second arrondissement. Yes, like Paris and Marseille, Lyon is a city divided into arrondissements.

Like these other cities, Lyon has a diversified transport network, based on the metro, tramway, bus and even the funicular. With its 6 million tourists per year, its basilica, its parks and museums, Lyon will make a good return on a short-term rental. As a business city, short-term flats are full, even in winter.

Buy to let Marseille

- 5.1% rental yield

- €3.600 average price/m2

The average return on rental investment in Marseille is 5.1% gross, making it one of the most attractive large French cities. However, like many cities, Marseille has been affected by rising property prices.

Rental returns have diminished by 0.5% in recent months. To counteract this trend, an increase in rental income will be necessary if you are buying, unless you prefer to rent on a short-term basis.

Indeed, Marseille is a prime destination. With its 170 sunny days a year, its blue coast and its Calanques, Marseille counts 5 million tourists every year. With an average price per square metre of €3,835, with a minimum of €2,222 in Notre Dame Limite and €6,328 in Les Goudes, Marseille is a great place to invest.

Buy to let Nantes

- 5% rental yield

- €4.500 average price/m2

Situated between Brittany, of which it was historically the capital, and the Vendée, Nantes is the capital of the Pays de la Loire region. With a population of over 300,000, the city has a very dynamic economy.

Nantes is the sixth most popular tourist destination in France and is one of the main destinations for mass tourism in the country. Between the castle of the Dukes of Brittany, its magnificent city centre, and the areas surrounding the city, buying a house in Nantes is a wise investment.

The gross rental yield is close to 5%, and the average price per square metre is less than €5,000, with a minimum of €3,843 per square metre in the Géraudière district, and a maximum of €5,354 per square metre in the Cité des Congrès.

Buy to let Bordeaux

- 4.1% rental yield

- €5.067 average price/m2

Bordeaux is the city of capital gains. With an increase in price per square metre of 73.97% in ten years, it is an investor’s paradise. The average gross rental yield in Bordeaux is around 4%.

This is not much for a long-term rental, but fortunately much lower than a short-term rental. Indeed, in the city centre, prices per night are barely lower than in the capital. Studios do not rent for less than 70 euros, and other properties can exceed 1000 euros per night.

When you consider that the average price per square metre is 5.067€, with a minimum of 4.629€ in Lac-Bacalan and a maximum of 5.596€ per square metre in the Hôtel de Ville district, Bordeaux is a city with great potential.

Sitting on the banks of the Garonne River, Bordeaux attracts wine lovers from all over the world. Known for its spirits, this city of only 250.000 inhabitants attracts more than 4 million stays each year, with an average duration of four nights.

It is therefore the perfect place to make a rental investment. Especially since companies like GuestReady, an Airbnb management company, can take care of guests and the property. With their multilingual team, they give you access to the 20% of Spanish, British and German tourists who flock to the city every year.

Buy to let Paris

- 2.5% rental yield

- 11.488€ average price/m2

Property investment in Paris struggles when compared to other cities in France. The average rental yield in Paris is between 2% and 3% gross. This means that rather than making money, investing in the capital could actually cost money.

Indeed, the average cost per square metre is €11.488, with a minimum value of 8.328€ per square metre in the Charles-Hermite-Evangile district, and a maximum value of 16.982€ per square metre in the Rennes district in the centre of Paris.

However, there are three main reasons to temper this judgment:

- This gross yield mainly concerns long-term rentals;

- The capital is subject to very high property inflation;

- The Paris region is a major economic hub;

- Let’s look at each of these points in detail, to understand why buying a flat in Paris is an excellent investment;

A very good return for short-term rentals

Buying real estate in Paris is a guarantee that you will have a property that can be rented out on a short-term basis all year round. Airbnb rentals are exploding in the capital. The supply of holiday accommodation is far below the demand.

No less than 33 million tourists visit the French capital every year, which is as many potential occupants of a well-located flat in Paris. This is without taking into account the price of holiday rentals in the centre of Paris.

With studio, flats renting for as little as 80€ per night, and luxury flats costing over 1.400€ per night, owning a place to stay in Paris is a real bargain.

A strong increase in value at the sale

Paris has seen a 56.59% increase in the price per square metre in ten years, while the national average is only 22%. The trend is not about to be reversed. Why is this so? Because Paris is the capital.

Just like London, Singapore and New York, the major metropolises have never experienced a long-term decline in their property market, quite the contrary. Judging by the cost per square metre in these other cities, Paris will continue to experience very strong increases.

Paris is the economic heart of France

The Île-de-France region has more than 12 million inhabitants and a GDP of 726 billion euros, which is more than twice as much per capita as the other regions of France. In other words, the big money is in Paris, as are the headquarters and the high salaries.

Many workers in the financial sector, for example, rent Airbnb for a few months, and the price is not a barrier. Short-term accommodation on Airbnb is easier to rent than queuing for long-term accommodation.

Is buying property in France a good investment?

When considering the quality of an investment in real estate, two essential questions arise:

- What is the property rights regime?

- Is there a risk related to natural disasters?

As far as property rights are concerned, France, unlike England or certain Asian countries, does not use the technique known as “leasehold”. Thus, once your property has been purchased and registered in your name with a notary, not only will you own your property for an unlimited period, but your children will inherit it.

In France, the right to property is considered “inviolable and sacred”, according to the very terms of Article 17 of the Declaration of the Rights of Man and of the Citizen (DDHC) of 1789, which forms part of the constitutional bloc. In other words, this right has constitutional value. It is also reinforced by Article 1 of the European Convention on Human Rights and Fundamental Freedoms (ECHR), to which France is a party.

As far as natural risks are concerned, before buying a property in France, you are given a document called ERP, for “état des risques et pollutions”. It lists all the known risks that are likely to affect the property in the area in which it is located. These include:

- Seismic risk;

- Exposure to radon;

- Soil pollution;

- Technological or mining risks;

- Natural risks (floods, storms, avalanches, etc.);

Real estate investment in France is therefore particularly well regulated and protected by constitutional provisions that ensure the peaceful enjoyment of the property purchased. Once you are sure of this, it is worth looking at the long-term returns.

What is the average rental yield in France?

The average rental yield in France is around 6%. However, the disparities are extremely large. Between Paris, which has an average gross rental yield of 3.08%, and Roubaix, which has an average gross rental yield of over 10%, the investments are not at all the same.

This is exactly why it is important to think about the type of rental you want to set up. Indeed, a property rented out on a short-term basis in Roubaix would not have the same occupancy rate as a property rented out on a short-term basis in Paris.

Consequently, the rental yield, calculated on the basis of the rental price for long-term rentals, can be beaten by tourism. When it comes to short-term rental investments, the vacancy rate decides everything.

Why invest in property in France?

France is experiencing a positive evolution of the property market. It was spared from the speculative movements that hit Spain in 1999 or the securitisation of mortgage loans that hit the United States in 2008.

However, while it has been spared these serious crises because the country has never resorted to the same causes, a real estate bubble is regularly forming in the country. How does this happen? Quite simply when property prices rise faster than household incomes. This artificial increase in prices is a natural trend in any market. These increases and contractions are normal.

However, property prices can also be affected by external interventions, such as new legislation. This is exactly what happened with the law of 22 August 2021, known as the climate and resilience law, which prohibits any rental of a property with an energy performance diagnosis of F or G.

The result is a current price drop of 15% on old housing. Housing that can no longer be rented out from 1 January 2023. Consequently, before buying a property, it is advisable to find out about the legislative trends. In the case of new buildings, nothing negative is to be expected, quite the contrary.

Can foreigners buy real estate in France?

Yes. As a foreigner, you should know that the application of the law is strictly identical for all litigants. Whatever the nationality of the parties to a dispute, the law is applied in the same way by the judge.

As the French State is a unitary, i.e. centralised, State, the application of the law is uniform throughout the country. Each court interprets the law according to the case law of the Cour de Cassation, the highest French court.

Therefore, foreigners can not only buy real estate in France but also be protected in their rights in exactly the same way as French citizens.

What is the tax on rental income in France?

French tax regimes are complex, with many exceptions. It is important to analyse the different regimes carefully before opting for one or the other. The following are only very general. They provide you with the keywords that will enable you to consult these regimes in detail on the République Française website.

Two main tax regimes apply to rental income in France. They are distinguished by the type of property rented, between :

- Rental income from furnished properties;

- Rental income from unfurnished properties;

For rental income from furnished properties, which should be prioritised when you want to make short-term rentals, these are considered industrial and commercial profits (BIC). Under 23,000 euros of annual rental income (per member of the tax household), you can remain a non-professional furnished rental operator (LMNP). Above this figure, you become a professional and are entitled to an allowance of between 50% and 71%.

In LMNP, you can opt for two types of taxation:

- Micro-BIC;

- The real regime;

The first allows you to benefit from a 50% allowance, but the social security contributions, i.e. 17.2%, must be paid to the tax authorities. The real regime can be interesting but requires a chartered accountant to complete your declaration. This cost should therefore also be taken into consideration.

Conversely, if your rental income comes from unfurnished properties, it is considered to be land income. You can then opt for two different tax systems:

- The micro-financier system;

- The actual system;

In both cases, social security contributions on your profits amount to 17.2%, plus the levy on your income, which is at least 11%, and can reach a maximum levy of 45%.

Is this the right time to buy real estate in France?

This question depends on the duration of your investment. Typically, property investment is made to last 20 or 30 years. It is therefore a long-term investment.

When you are thinking of investing over two or three decades, there is no right or wrong time to invest. Whether you invest at the bottom of the wave, or when the market is at its peak and is going to go down, you will not lose money after 20 or 30 years.

This rule is exactly the same as the one for the stock market. If you look at the share price today, compared to the lowest rate linked to the subprime crisis in 2008, you see that an index like the S&P500 is much higher than in 2012, for example.

It is exactly the same for the real estate market. Therefore, buying a house in Bordeaux or Saint-Etienne today will be a winning bet over two decades, both in terms of rental income and capital gains on sale.

Short, mid or long-term?

All they are debatable. In the medium term, while the risk of loss remains low, the risk of not gaining anything is higher. In the short term, the risk of loss can be very high for several reasons:

- The type of property;

- The market trend;

By type of property, we mean the age of the property and its quality. Indeed, the older the property, the more work it requires, and therefore the more it costs. These expenses will not be recouped in the short term, either by rent or by a capital gain on the sale.

The market trend may also be downward or may become so following a factory closure or other particular event. Short-term investments, therefore, require a very precise study of the location in which you wish to buy. You should analyse the local economic fabric so that you know who the major local employers are, their financial health, and the trend in their market.

You cannot invest in the short term in a city like Clermont-Ferrand and not be interested in the financial health of the Michelin factory, the largest employer in the Auvergne region with 14.200 employees.

To maximise your income, you should opt for a short-term rental in a tourist region, less subject to the vagaries of the local industrial economy. To be able to buy wherever you want, it is possible to entrust the management of your property to a company like GuestReady, which specialises in Airbnb rentals.

Conclusion

Investing in property in France is particularly profitable for short-term rentals. There is no better place to invest in property in France than in tourist areas, because is one of the countries with the most visitors in the world.

Companies such as GuestReady now make it possible to invest in any city in France with the assurance that the property will be rented out in the short term.

With services that include posting ads, hosting guests and cleaning the flat, there is no reason to hesitate to maximise rental returns via Airbnb so let us help you on this profitable journey, get in touch!