Turning empty rooms into revenue: Where UK hotels can thrive

New analysis reveals that turning empty rooms into revenue could be the key to helping UK hotels recover lost income. Empty hotel rooms are costing UK cities thousands of pounds each week, with London, Edinburgh, and Oxford facing the highest financial losses.

Across the UK, fluctuating occupancy rates and changing travel behaviours continue to hit the hospitality sector. The data shows that, on average, an empty hotel room sees between £53 and £22 per night in lost revenue, depending on the city.

New analysis from GuestReady reveals the weekly cost of unoccupied hotel rooms across the UK, alongside a look at competition density, offering potential insights for prospective hotel owners.

High weekly losses highlight untapped potential

Across the UK, empty hotel rooms are costing cities hundreds of thousands of pounds each week. London tops the list, losing £39,604 per week (£53 per room). With average room prices in London exceeding £240 a night, even marginal drops in occupancy translate into significant losses for hoteliers.

Tourism hubs face mounting pressure

Edinburgh and Oxford follow closely behind, losing £35,555 and £31,218 per week, respectively, or £47 and £42 per room per night. These cities rely heavily on seasonal tourism and student travel, leaving them particularly vulnerable during off-peak months.

York, Manchester, and Bristol round out the top tier, losing between £26,000 and £29,000 a week. These cities have invested heavily in boutique stays and heritage tourism, but still face challenges in sustaining high occupancy year-round.

A nationwide challenge

Further down the list, smaller but still popular destinations like Cambridge, Belfast, and Plymouth are each losing over £23,000–£25,000 a week due to unfilled rooms – a reminder that this issue extends beyond the largest urban centres.

The pattern extends nationwide, with every major UK city losing thousands weekly due to unfilled capacity. Even smaller destinations like Gloucester, Exeter, and Swansea report weekly losses of nearly £20,000, while Aberdeen, Hull, and Wolverhampton each lose around £16,000–£17,000.

| FULL WEEK | PER ROOM/WK | |||

|---|---|---|---|---|

| City | MADE | LOSS | MADE | LOSS |

| London | £180,416 | £39,604 | £241 | £53 |

| Edinburgh | £112,591 | £35,555 | £150 | £47 |

| Oxford | £98,856 | £31,218 | £132 | £42 |

| York | £90,447 | £28,562 | £121 | £38 |

| Manchester | £87,500 | £27,632 | £117 | £37 |

| Bristol | £85,445 | £26,982 | £114 | £36 |

| Cambridge | £80,334 | £25,369 | £107 | £34 |

| Belfast | £79,508 | £25,108 | £106 | £34 |

| Birmingham | £75,263 | £23,767 | £100 | £32 |

| Glasgow | £75,061 | £23,704 | £100 | £32 |

| Plymouth | £74,619 | £23,564 | £100 | £31 |

Competition matters: density of hotels across cities

Potential hotel owners should not only consider current losses but also the level of competition in a city. Our analysis of Booking.com listings against city size shows that the density of accommodation varies widely:

| City | All properties on booking.com | square miles | places to stay per sq mile |

|---|---|---|---|

| Manchester | 2159 | 45 | 48 |

| Norwich | 518 | 15 | 35 |

| Brighton | 1101 | 32 | 34 |

| Oxford | 576 | 18 | 32 |

| Liverpool | 1336 | 43 | 31 |

| Durham | 176 | 6 | 29 |

| Cambridge | 417 | 16 | 26 |

| Nottingham | 752 | 29 | 26 |

| Bristol | 1001 | 42 | 24 |

| London | 14,269 | 607 | 24 |

Manchester stands out with 48 hotels per square mile, the highest density in the UK. This indicates strong competition but also confirms that the city has a thriving hospitality market with consistent demand – losses from empty rooms could represent opportunities for smart operators who differentiate through experience, location, or service.

By contrast, cities like Bradford (1 per sq mile), Milton Keynes (3), and Swansea (3) have very low density, suggesting that a well-positioned new hotel could capture a significant market share with limited direct competition.

Competition insights: less crowded markets offer big potential

When evaluating new hotel investments, understanding the local competitive landscape is just as important as revenue potential. Cities like Manchester, with 2,159 properties across 45 sq miles (48 places per sq mile), offer a strong balance of demand and room for growth. By contrast, London has more properties (14,269), but lower density per square mile (24), highlighting opportunities in dense urban areas.

Some other cities with promising opportunities include:

| City | Total properties | Area (sq miles) | Properties per sq mile |

|---|---|---|---|

| Manchester | 2,159 | 45 | 48 |

| Oxford | 576 | 18 | 32 |

| Brighton | 1,101 | 32 | 34 |

| Cambridge | 417 | 16 | 26 |

| Liverpool | 1,336 | 43 | 31 |

| Norwich | 518 | 15 | 35 |

Hoteliers can use this data to spot high-demand, low-competition areas where new ventures or expansions can thrive.

Balancing opportunity with market saturation

For prospective hotel owners, the key is balancing lost revenue potential with competition levels:

- High competition, high-loss cities (Manchester, London, Edinburgh): Entering these markets requires a unique selling point – boutique experience, wellness facilities, or premium positioning. While demand exists, standing out is critical.

- Low competition, moderate loss cities (Bradford, Milton Keynes, Swansea, Gloucester): These markets offer the potential to establish first-mover advantages but require careful planning to ensure demand exists, especially during off-peak seasons.

How hotels can maximise revenue during high-demand months

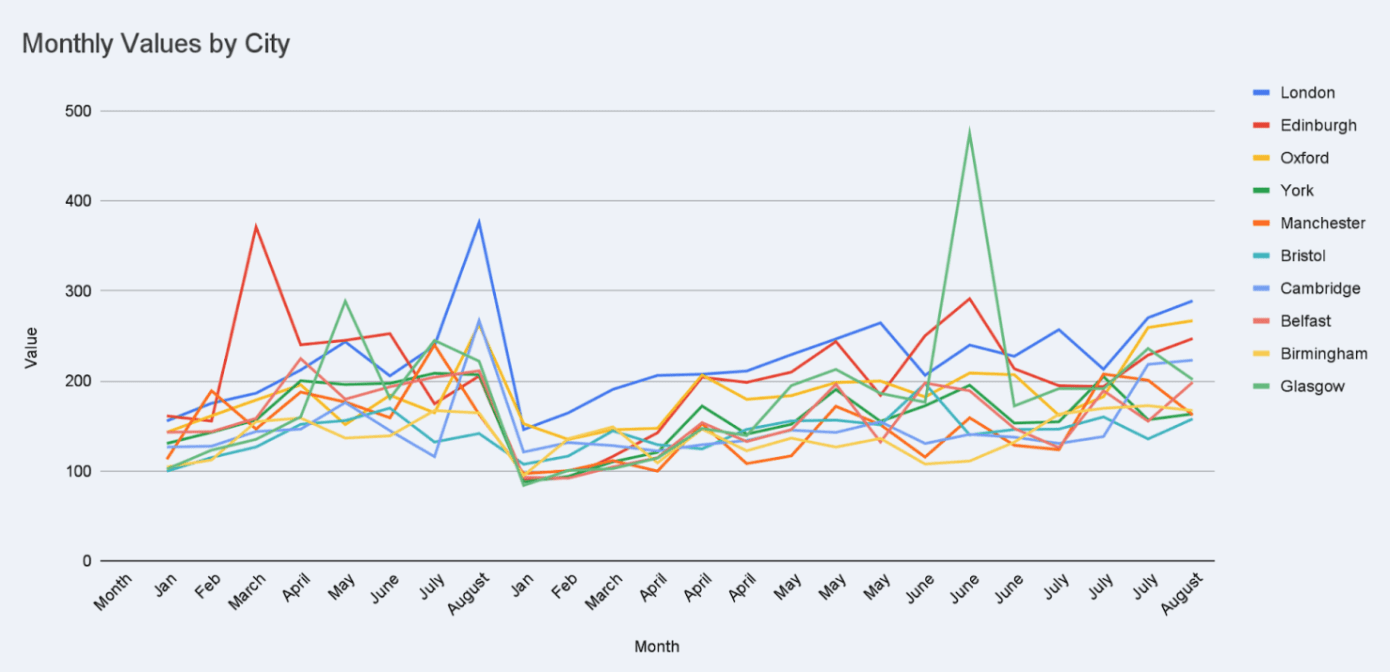

Analysis of UK hotel price data across 10 major cities reveals how average nightly rates fluctuate between midweek and weekend stays – and how smart pricing strategies can help boutique and independent hotels turn empty rooms into revenue during seasonal peaks.

The data shows that demand-driven pricing continues to thrive, with cities like London, Glasgow and Edinburgh seeing dramatic rate surges during key months such as December and August. The findings underline how small adjustments to pricing, operations, and experience design can lead to significant revenue gains throughout the year.

London leads on festive demand; December weekend rates reach £376, compared with £156 in January – a 141% increase. Peak months in London are the summer months of June–July, likely due to the influx of events to the capital, such as Wimbledon and the British Summer Time Festival, and December.

By leveraging event-led tourism (such as Christmas, summer festivals, and Wimbledon), hoteliers can market premium packages and early-bird promotions. Edinburgh also benefits from events in the city, with weekends during the Edinburgh Fringe Festival coming at a premium. Weekends in August outperform midweek rates by up to 220% in festival months.

Regional cities like York and Belfast show steady gains. York’s rates climb from £131 in January weekends to £207 in December, reflecting strong Christmas market tourism.

Midweek opportunities remain untapped. Across most cities, midweek rates average 20–30% lower than weekends. Boost midweek occupancy through business partnerships, local staycations, and remote-work packages.

Key takeaways for hoteliers

Taken together, the 36 cities analysed represent a combined weekly loss of more than £820,000 from unoccupied hotel rooms. With margins already under pressure from inflation, staffing shortages, and rising energy costs, these figures reveal the scale of opportunity for UK hoteliers.

By turning empty rooms into revenue through smart pricing strategies, targeted local tourism campaigns, and short-term stay incentives, hotels can help stabilise occupancy rates and strengthen performance during slower trading periods.

Manchester remains a hotspot; while seeing high weekly revenue losses, there is strong demand in the city, suggesting opportunities for niche hotels or differentiated stays targeting business and leisure travellers. Low-density cities offer untapped potential; investors willing to target smaller cities with fewer competitors could capture significant market share.

Focus should be on experience-driven differentiation; varied food and beverage offerings, wellness services, or unique packages can convert vacant room losses into booked stays.

Seasonal and domestic travel matters: cities dependent on tourism (Edinburgh, York) or student populations (Cambridge, Manchester) require careful attention to booking patterns throughout the year.

By combining revenue loss data with competition density, prospective hotel owners can identify where investment could yield the highest returns — either by capitalising on high-demand, competitive cities or by establishing a presence in underserved markets with strong growth potential.

Empty rooms don’t just represent lost income for hoteliers—they also mean fewer local jobs supported, less tourism spend in surrounding areas, and slower recovery across the visitor economy.

To tackle the issue, experts at GuestReady point to four key strategies:

- Dynamic pricing: Using real-time data to adjust rates and fill gaps during low-demand periods.

- Local marketing: Targeting domestic travellers through short-break campaigns and off-season offers.

- Delight guests with five-star service at every touchpoint: Personalised welcomes, small surprise upgrades, or thoughtful gestures (like local treats or handwritten notes) can transform a standard stay into a story worth sharing.

- Embed local culture and attractions into the guest journey: Partner with nearby restaurants, artisans, or tour guides to offer exclusive experiences – such as private tastings, guided walks, or “locals-only” recommendations delivered via in-room tablets or email itineraries.

If each of these cities improved occupancy by just 5%, it could unlock tens of millions of pounds in additional annual revenue for the UK’s hospitality and travel sector – breathing new life into one of the country’s most valuable industries.

The GuestReady advantage

In a landscape where every booking counts, GuestReady empowers hotel owners to unlock hidden revenue, elevate guest satisfaction, and build long-term resilience.

With the right blend of technology, hospitality expertise, and local insight, GuestReady isn’t just helping hotels fill rooms, it’s helping them thrive. Empty rooms are wasted potential. GuestReady turns them into opportunity. One stay, one story, one guest at a time.